How To Invest $500 To Earn $10,000 Each Year

- Solomon Floyd

- Jan 16, 2023

- 3 min read

By Solomon Floyd, Managing Partner RVPP

Introduction

For many new investors, the process of buying their first rental or flip seems like a daunting task. Interest rates keep rising, home prices are still high, and job security is wavering. "Who in their right mind would try to buy an investment property in this market?"

What if I told you that you could still invest in real estate and increase your passive income by as little as $500 per month? What if I told you this method could yield you $10,000 every year to put towards your goal? Well, I have good news for you! It's 100% possible and you’re going to learn how to do it.

We will be utilizing the example in this whitepaper assuming we are investing into a Real Estate Investment Trust (REIT) or Fund. REITs offer investors of all sizes a straightforward way to add the historically strong investment class of real estate to their investment portfolios. Today, more than 87 million Americans are estimated to own REIT shares. For many private investors seeking to invest in real estate, the best option is to invest in assets being acquired and managed by a third-party professional investment manager, called a “sponsor.” This can be in the form of a fund that combines existing assets with future acquisitions. Such investments have many advantages.

LET’S think like an investor

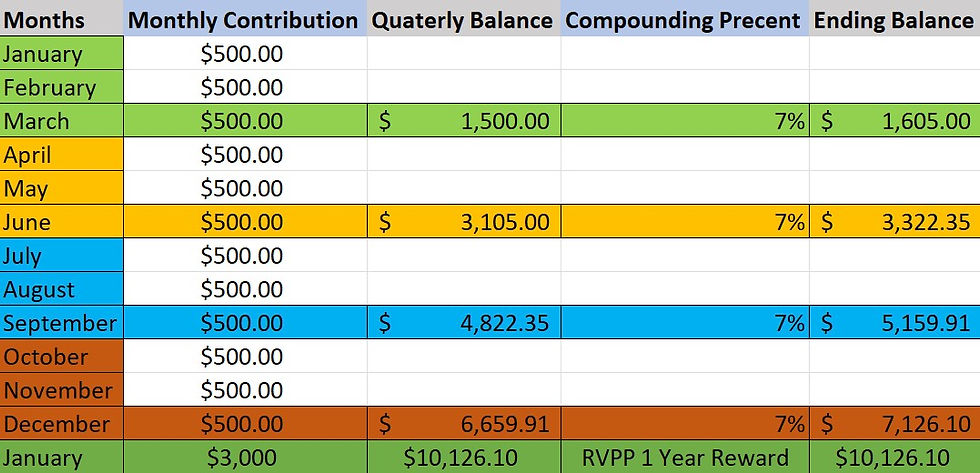

The easiest way to get into the investor mindset is by separating the year into four quarters. This is the best metric for tracking growth over a three-month period, giving you actionable insights into your investment’s performance. Below you’ll see the breakdown of each quarter and the sample amount you would have after investing $500 per month.

Q1 (Jan-March) $1,500

Q2 (April-June) $1,500

Q3 (July-Sept) $1,500

Q4 (Oct-Dec) $1,500

Total Invested over the year $6,000.00.

For this example, we will be starting out with a $500 investment each month into our sample fund "Fund1.” Every quarter, whatever we put into Fund1 will earn 7% and since there are 4 quarters in a year, you can think about it as roughly 28% annualized return (7×4=28). This is the type of return you'd see from owning a rental property or two.

The Graphic Explained:

Let's say you invest $500 per month for Q1. $500x3=$1,500, remember that this $1,500 will grow by 7% each quarter meaning that you will now have $105 in earned income. Your investment value is now $1,605.

Now Q2 has started, and you have invested another $1,500, this is added to your current amount. $1,605 + $1,500= $3,105 +7% (growth every quarter) = your new value of $3,322.35.

Q3 follows the exact same investment pattern. $1,500 plus your new value $3,322.35 + $1,500= $4,822.35 total invested cash+ 7% (growth every quarter) = your new value of $5,159.91

Q4, you guessed it... is the exact same. Your $500x3=$1,500 plus your new value $5,159.91 + $1,500= $6,659.91 total invested cash+ 7% (growth every quarter) = your new value of $7,126.10

Easy Enough?

What would you do with an extra $7,000 per year? The best option would be to reinvest this cash or keep adding to it and growing it by 28% ($8,960 if you do not contribute $1,500 each quarter). This can be achieved with any investment amount you want, and it works the same way. If your goal is to build passive income while you wait to buy your first rental, this is the key.

Reinvest & Replicate:

For those of you thinking "Wait, didn't you tell us this would pay $10,000 per year?". I have one recommendation that fits our Fund1 example, it pays 7% and up per quarter as well as gives you an extra $3,000 for contributing $500 every month for a year. Reunion Variable Income Fund provides investors with the ability to earn cash flow and build their portfolios.

RVPP Fund:

RVPP is a diversified income fund that combines a cash flowing portfolio of properties across each asset type to provide a preferred rate of return for its investors. With no minimum investment or limit, you can remain flexible with how you use your liquidity. RVPP is perfect for new investors who are looking to create a solid base for passive income generation.

Check the links below and be sure to schedule a time to ask questions. If you found any of this helpful, be sure to subscribe too. I wish you the best of luck.

RVPPFund.com- Fund

RadDiversified.com- REIT

Key Takeaways

· Anyone can start investing in passive income at any time with any amount.

· Understand the importance of a compounding return.

· Choose the right fund that can help you get where you are trying to go.

· RVPP pays $3,000 to investors who make a $500 contribution each month for one year.

Sources & Resources

What is a REIT?-https://fundrise.com/education/reits-101-a-beginners-guide-to-real-estate-investment-trusts

Comments